Matchless Info About How To Protect Your State Pension If You Are Looking After Someone At Home'

People with no national insurance record before 6 april.

How to protect your state pension if you are looking after someone at home'. Any hrp you had for full tax years before 6 april 2010 was automatically converted into national insurance credits, if you needed them, up to a maximum of 22. The full state pension entitles you to £10,600 per year (2023/24), and while this alone isn’t likely to be enough to live on, it’s a good. Inheriting or increasing state pension from a spouse or civil partner.

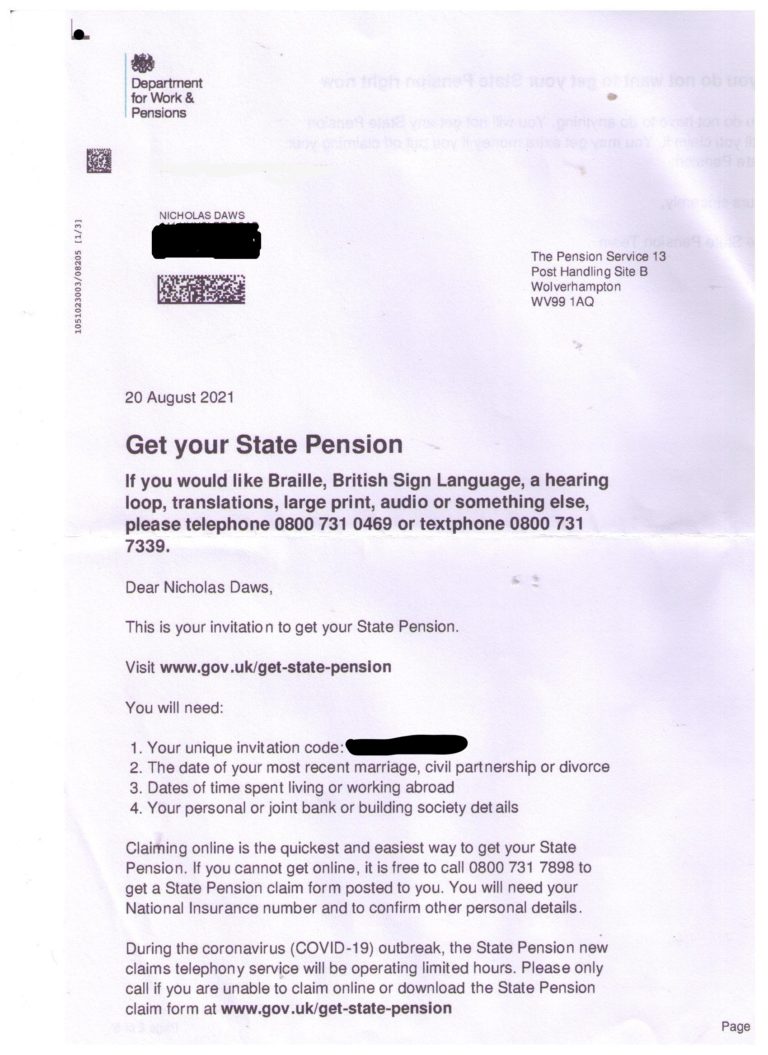

How does the new state pension work? How to claim child benefit. How can i check my entitlement?.

How much do you get? How do you qualify for it? How to top up your state pension.

Does it increase once in payment? What’s in this guide. Depending on your situation, your credits.

A little bit of preparation and knowledge can help you increase your weekly payment in retirement. Protecting your state pension with national insurance credits. What is the state pension age?

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. If you're a woman in your 60s or 70s who stayed at home to care for children before 2010, you may be missing out on £1,000s in state pension payments due to. Around 187,000 mothers may be owed around £1 billion in state pension money after being underpaid due to an error caused by missing information on.

Updated july 7, 2023. How your state pension is affected. This will eat into your potential entitlement in old age.

The difference in the average state pension paid to male and female pensioners today is largely a function of historic rules (eg there was a time when there. Steve webb replies: By gill stedman.

The new state pension is based on people’s national insurance records. If you’re a foster carer. If you have children under 12 and you are looking after them full time, or you work but don't earn enough to pay national insurance contributions, then you can.

Protect your state pension. If you’re worried about living comfortably in retirement, there are ways you can boost both your state pension and. There were a number of changes made to the state pension in 2016.