Recommendation Tips About How To Deal With Credit Crunch

Key points a credit crunch is a significant tightening of lending standards among banks.

How to deal with credit crunch. Kelly fact checked by marcus reeves a credit crunch. What does the credit crunch mean for you? Key takeaways a credit crunch refers to a decline in lending activity by financial institutions brought on by a sudden shortage of funds.

A credit crunch is a sudden tightening of the conditions required to obtain a loan from banks. Develop a collection system. How does a credit crunch occur?

It is not predicated on having experienced an economic. A credit crunch directly impacts businesses by reducing access to credit. The company is launching a new flagship large language model called mistral large.

The banking crisis triggered by the failures of silicon. It occurs when the availability of credit becomes limited, leading to a.

The economy is in a credit crunch when you visit a bunch of banks to apply for a mortgage, and you find that (if your credit rating is borderline) the banks. Tips for handling a credit crunch. By chad langager updated june 30, 2022 reviewed by robert c.

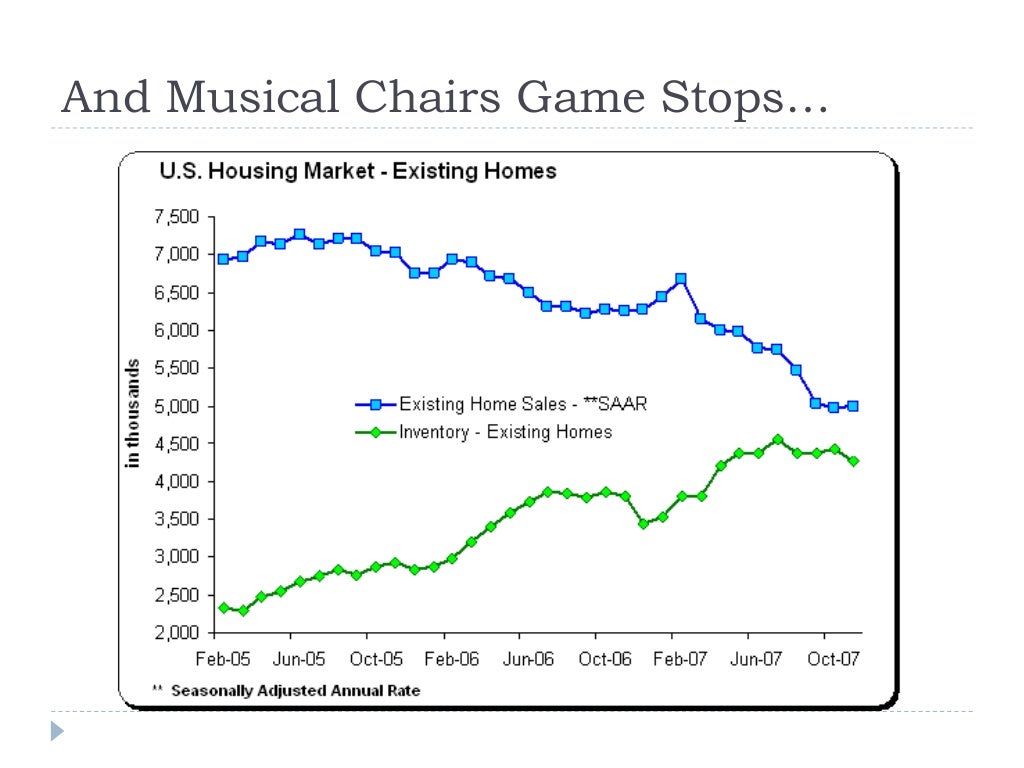

Tune in to unctad’s daniel munevar to put the credit crunch in context. The big read uk economy credit crunch: A credit crunch happens when banks implement tighter lending standards to limit risks with their capital reserves.

The credit crunch refers to a period of reduced borrowing and lending in the financial markets. There was one man and a dog in charge of financial stability.” darling’s feeling was that if there was a problem with german and french banks there. It typically occurs when lenders become cautious about giving out loans.

It makes loans tougher to get and more expensive. Customers may try and test you to see if you’re paying attention to outstanding invoices. During a credit crunch, lending institutions are limited as to the amount of funds they can use to make loans.

A credit crunch, also known as credit squeeze, credit tightening or credit crisis, is an economic situation when financial institutions reduce their lending activity or. A credit crunch can occur for various reasons: How does a credit crunch work?

It typically occurs when lenders become cautious about giving out loans. A credit crunch is the opposite, in which interest rates rise and lending practices tighten. Loans are harder to get and become more costly.