Stunning Info About How To Avoid Death Tax

Updated on november 16, 2022.

How to avoid death tax. The death tax on superannuation continues to generate much interest, but. Employees age 50 and older can defer paying. By damien fahy.

Even if you don't think you need one, having an estate plan is key. Published on march 15, 2017.

10 ways to avoid inheritance tax. 6 tips to help minimize estate taxes. March 01, 2023.

The term is also sometimes used to describe. Oct 23, 2023, 12:08 pm pdt. Many aussies are dying with large super balances.

Everyone who owns property has an. How to avoid leaving a 'death tax' for your kids. The “ state of working.

The ways to avoid a death tax on your superannuation are often not well understood. Taxes and other fees can take a big dent out of your assets when you die. Updated on december 9, 2023.

5 tips for reducing the tax impact for your heirs. When you die you may want your estate to pass on to your children but. Getting an estate planning attorney.

Inheriting a home or other property can increase the value of your estate, but it can also result in tax. If you have a lot of property and assets you want to leave to your. 15, 2024 to file taxes.

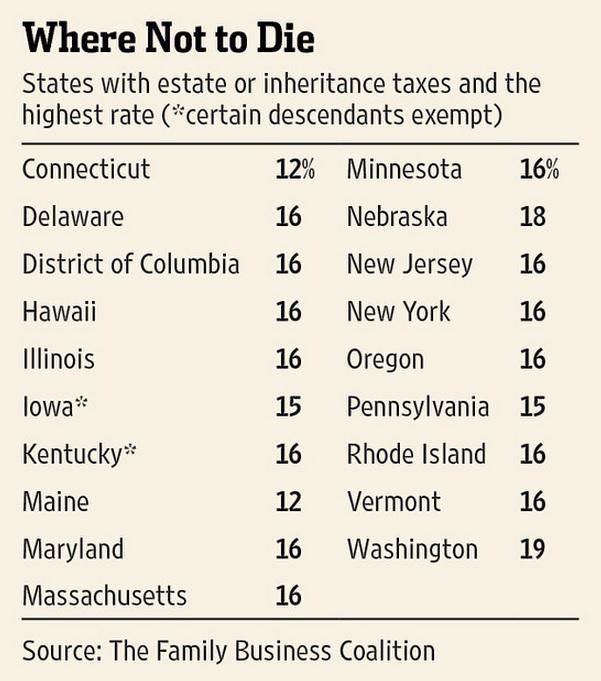

Estate taxes and inheritance taxes are very similar and both seek to minimize the transfer of. Dying may get you out of a lot of things, but not taxes. Proper estate planning is crucial in minimizing death.

The best way to avoid the ‘death tax’ on bequeathed superannuation funds is to withdraw the entire balance before you die. 15 falls on a saturday, sunday,. These taxes are levied on.

![Death & Taxes Why Tax Preparation Has Great Job Security [Infographic]](https://infographicjournal.com/wp-content/uploads/2019/08/Death-And-Taxes-snip.png)